EUR/USD flirts with 3-day highs around 1.0600 ahead of US Payrolls

- EUR/USD adds to Thursday’s advance and hovers around 1.0600.

- ECB’s Panetta, McCaul, Lagarde speak later in the session.

- Markets’ attention remains on the release of US NFP.

EUR/USD advances to 3-day highs just above 1.0600 the figure amidst some tepid selling pressure around the greenback on Friday.

EUR/USD looks at USD, Payrolls

EUR/USD extends further the bounce off multi-week lows recorded in the wake of Powell’s first testimony on Tuesday and pierces the 1.0600 barrier at the end of the week.

In fact, the renewed offered bias in the greenback forced the USD Index (DXY) to give away part of the recent upside in tandem with the loss of traction in US yields across the curve and dwindling bets of a half percentage point interest rate hike by the Fed at the March 22 meeting.

Moving forward, the release of February’s Non-farm Payrolls has been growing in importance as of late and will be the salient event later in the NA session.

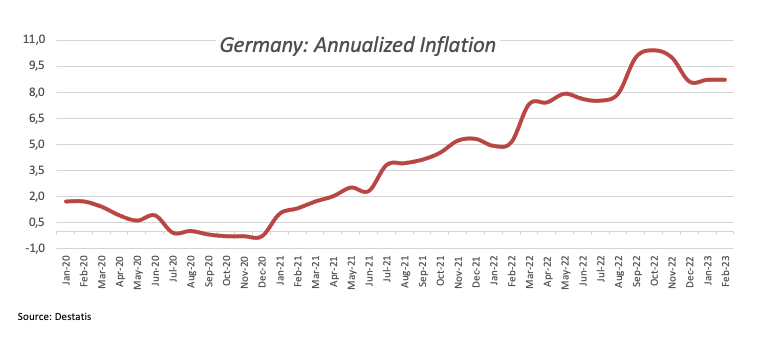

Closer to home, ECB’s F. Panetta, E. McCaul and Chair C. Lagarde are all due to speak. Earlier in the session, final inflation figures in Germany showed the CPI rising 8.7% in the year to February and 0.8% from a month earlier.

What to look for around EUR

EUR/USD finds some courage and advances just beyond the 1.0600 barrier ahead of the US NFP for the month of February, extending at the same time the optimism seen in the second half of the week.

In the meantime, price action around the European currency should continue to closely follow dollar dynamics, as well as the potential next moves from the ECB after the bank has already anticipated another 50 bps rate raise at the March event.

Back to the euro area, the likely continuation of the normalization process by the ECB beyond the March meeting carries the potential to reignite recession concerns.

Key events in the euro area this week: Germany Final Inflation Rate, ECB Lagarde (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle amidst dwindling bets for a recession in the region and still elevated inflation. Impact of the Russia-Ukraine war on the growth prospects and inflation outlook in the region. Risks of inflation becoming entrenched.

EUR/USD levels to watch

So far, the pair is advancing 0.11% at 1.0590 and the breakout of 1.0694 (monthly high March 7) would target 1.0712 (55-day SMA) en route to 1.0804 (weekly high February 14). On the downside, the initial support comes at 1.0524 (monthly low March 8) seconded by 1.0481 (2023 low January 6) and finally 1.0323 (200-day SMA).