USD/JPY Price Forecast: Turns bearish, breaches Ichimoku Cloud and 200-DMA

- USD/JPY sinks 1.13%, falling sharply to 152.59 as it moves decisively below the 200-day SMA and Kumo.

- Potential recovery hinges on reclaiming the 153.00 level, with resistance near the Kumo's lower edge at 153.35/40.

- Continued downtrend could target longer-term supports at December lows of 149.36 and 148.65.

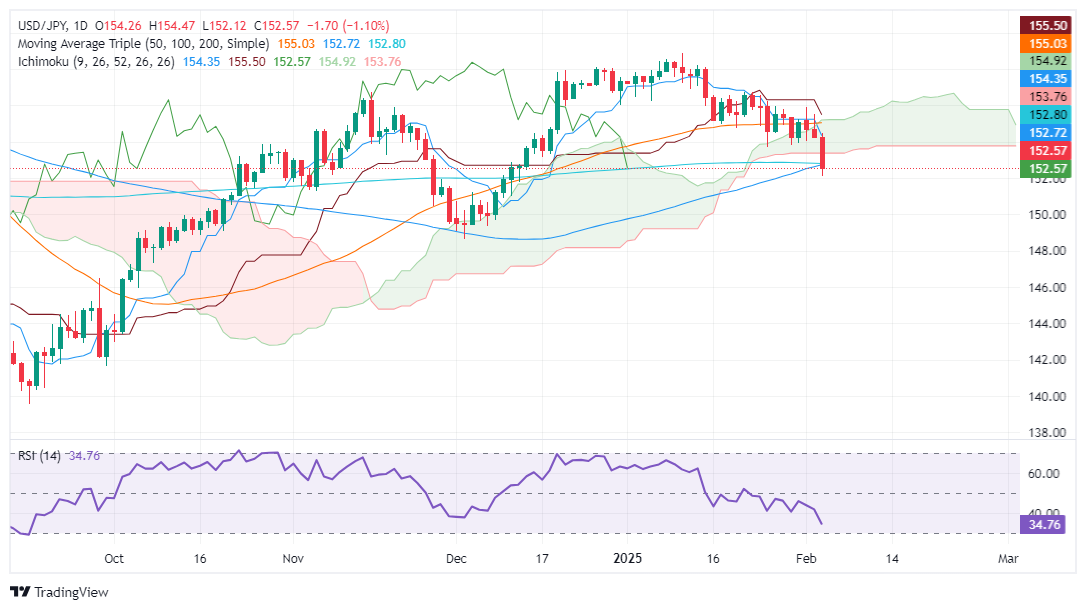

The USD/JPY plummeted 175 pips on Wednesday, posting losses of over 1.13% as the pair cleared the Ichimoku Cloud (Kumo). This cements the pair's downtrend, with the Japanese Yen (JPY) set to appreciate in the short term. At the time of writing, the pair trades at 152.59.

USD/JPY Price Forecast: Technical outlook

Bears stepped in on Wednesday, pushing the USD/JPY below the Kumo and breaching the 200-day Simple Moving Average (SMA) at 152.80. This has opened the door for further downside.

Despite this, a leg-up is on the cards, if buyers clear the 153.00 figure, which could pave the way to test the bottom of the Kumo at 153.35/40, offering sellers a better entry price. However, if it surpassed, the next resistance would be the 154.00 mark, followed by the February 5 high at 154.46.

If the downtrend continues, the USD/JPY first support would be the December 6 low of 149.36, followed by the December 3 low of 148.65.

USD/JPY Price Chart – Daily

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.02% | -0.01% | -0.09% | -0.00% | 0.04% | 0.04% | 0.00% | |

| EUR | -0.02% | -0.03% | -0.10% | -0.02% | 0.04% | 0.03% | -0.04% | |

| GBP | 0.01% | 0.03% | -0.10% | 0.01% | 0.03% | 0.07% | 0.00% | |

| JPY | 0.09% | 0.10% | 0.10% | 0.07% | 0.12% | 0.10% | 0.11% | |

| CAD | 0.00% | 0.02% | -0.01% | -0.07% | 0.03% | 0.05% | 0.01% | |

| AUD | -0.04% | -0.04% | -0.03% | -0.12% | -0.03% | -0.01% | -0.05% | |

| NZD | -0.04% | -0.03% | -0.07% | -0.10% | -0.05% | 0.01% | -0.03% | |

| CHF | -0.01% | 0.04% | -0.01% | -0.11% | -0.01% | 0.05% | 0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).