Back

10 Jan 2020

Crude Oil Futures: rising odds for a deeper pullback

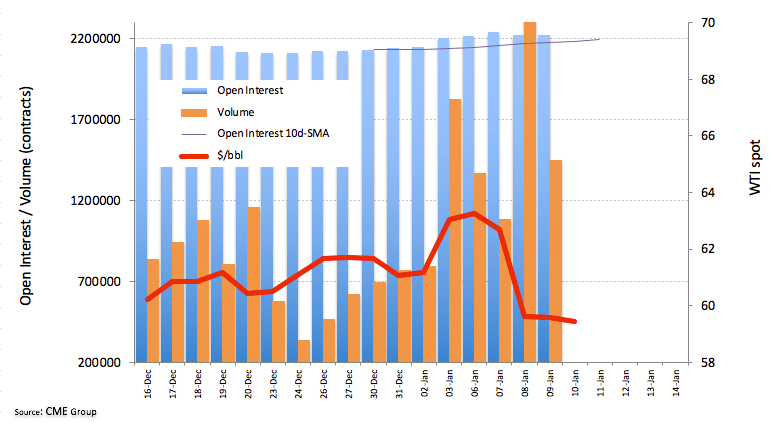

Initial estimates of Crude Oil futures noted open interest partially offset the previous drop and increased by just around 3.2K contracts on Thursday, according to CME Group. On the flip side, volume extended the erratic performance and shrunk by 991189 contracts.

WTI could test the 200-day SMA near $57.80

Crude oil prices continued to correct lower on Thursday, accelerating the downside after breaking below the key support at the $60.00 mark. Rising open interest amidst negative price action should keep the door open for extra downside in the near term. That said, the key 200-day SMA near $57.80 emerges as the next relevant target. On the other hand, the sharp drop in volume could slow the pace of the decline, or event spark some consolidation.