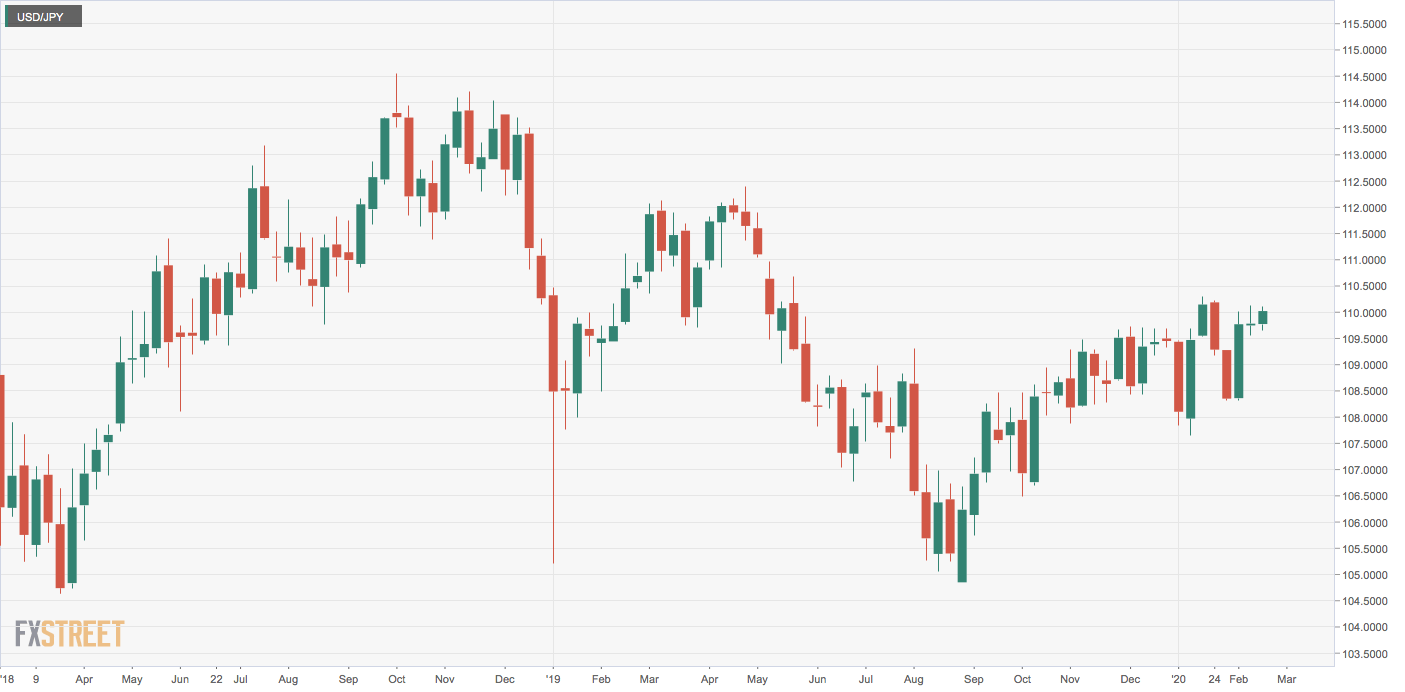

USD/JPY Price Analysis: Rises above 110, but bull breakout still elusive

- Uptick in the US equity index is boding well for USD/JPY.

- The pair needs to break above 110.29 to revive the broader uptrend.

The bid tone around the anti-risk Japanese yen weakened, allowing USD/JPY to rise to 110.11, as the futures on the S&P 500 ticked higher hinting at risk reset in the financial markets.

The US equities fell on Tuesday after Apple Inc said its revenue will be hit due to coronavirus. As a result, USD/JPY had dropped to a low of 109.66.

Bulls need further gains

While the recovery from 109.66 to 110.11 is encouraging, the pair is still trading within the range of last week’s Doji candle, meaning the market is still indecisive and the immediate outlook is neutral.

A break above 110.29 (January high) is needed to confirm breakout or continuation of the rally from the August 2019 low of 104.45.

Alternatively, a move below last week’s low of 109.56 would mean the period of indecision has ended in victory for the bears and could yield a deeper drop toward support at 108.30.

Weekly chart

Trend: Neutral

Technical levels