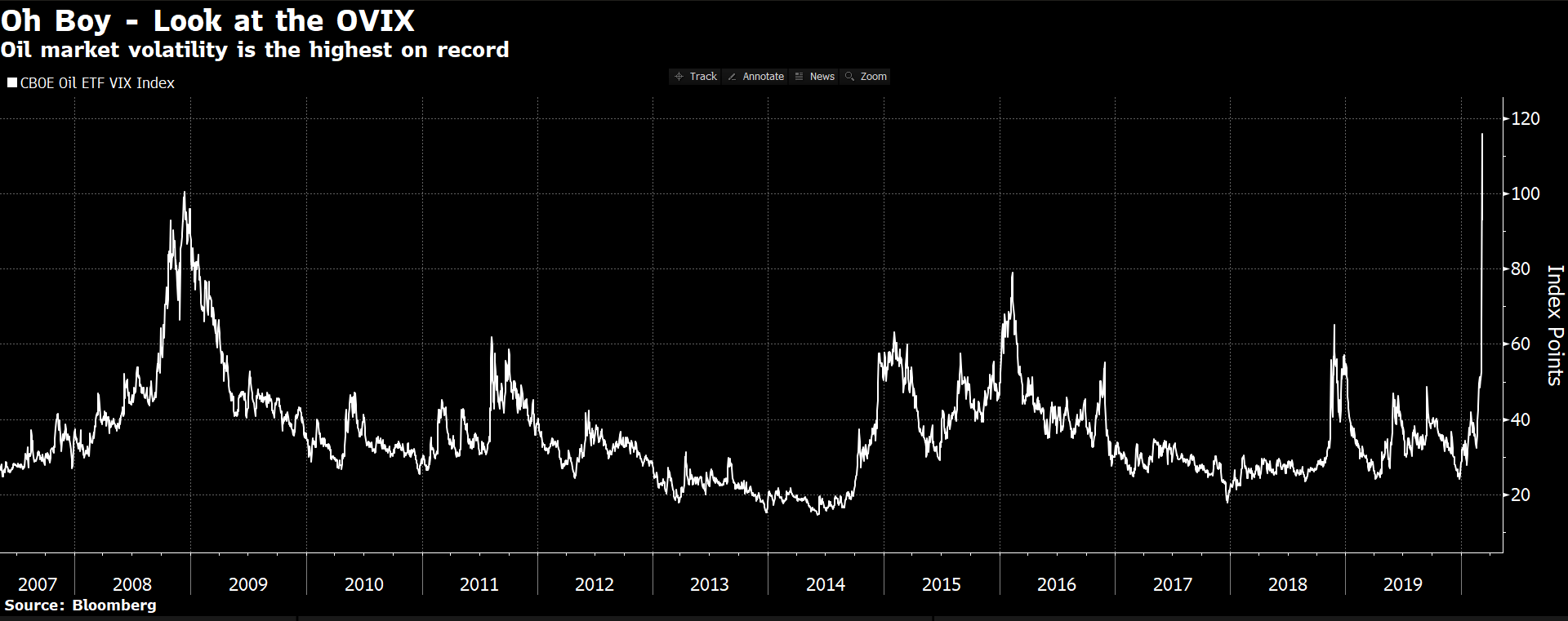

Oil price volatility index hits record high

The Cboe Crude Oil ETF Volatility Index jumped to a record high of 115.9 on Monday as prices fell sharply on prospects of an all-out price war between Saudi Arabia and Russia.

The index measures the market's expectation of 30-day volatility of crude oil prices by applying the VIX methodology to the United States Oil Fund, LP options spanning a wide range of strike prices.

Put simply, markets expect the black gold to remain quite volatile over the next 30 days.

"Things are unlikely to calm down for a while. The OVIX (Vix for the oil market), is its highest inception, including even the 2008 crisis," John Authers, senior editor at Bloomberg tweeted a few minutes before press time.

At press time, WTI is seen trading at $34.40 per barrel, having hit a low of $27.34 on Monday. Meanwhile, a barrel of Brent is currently changing hands at $37.60.