Spread dan ketentuan terbaik kami

Pelajari selengkapnya

Pelajari selengkapnya

Eurostat will publish the first estimate of Eurozone inflation and growth figures for July and Q2 2021 respectively at 0900 GMT on Friday.

The headline CPI is anticipated to rise to 2.0% YoY while the core inflation is seen dropping to 0.8% YoY in the reported month.

On an annualized basis, the bloc’s economy is likely to rebound sharply by 13.2% in Q2 while inter-quarter the GDP rate is expected to expand by 1.5% vs. -0.3% prior.

Ahead of this data set, Germany is set to publish its Q2 Preliminary GDP report at 0800 GMT, with the economy seen growing by 2% QoQ vs. -1.8% booked in the previous quarter.

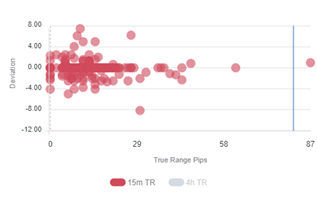

Readers can find FX Street's proprietary deviation impact map of the CPI below. As observed the reaction is likely to remain confined between 10 and 20 pips in deviations up to 3 to -4, although in some cases, if notable enough, a deviation can fuel movements of up to 30-45 pips.

Haresh Menghani, FXStreet's Analyst, notes important technical levels ahead of the key release, “from a technical perspective, the recent rebound from support marked by a short-term ascending trend-line stalled just ahead of monthly swing highs, around the 1.1900 neighborhood. The mentioned handle should now act as a key pivotal point for traders, which if cleared decisively should pave the way for additional gains. The subsequent short-covering move has the potential to lift the pair back towards the 1.2000 psychological mark. On the flip side, the 1.1850-45 region now seems to protect the immediate downside ahead of the 1.1800 mark and the 1.1770-60 region.”

EUR/USD eases below 1.1900, Eurozone GDP, US PCE Inflation eyed

Can markets in Europe finish higher for the sixth month in a row?

Forex Today: US dollar rebounds amid covid-led risk-off mood, US PCE inflation in focus

The Euro Zone CPI released by Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).

The Gross Domestic Product released by the Eurostat is a measure of the total value of all goods and services produced by the Eurozone. The GDP is considered as a broad measure of the Eurozone economic activity and health. Usually, a rising trend has a positive effect on the EUR, while a falling trend is seen as negative (or bearish).